"area" execs for the purpose of in-individual conferences are described as getting Positioned within just fifty miles of The patron's zip code. In-person meetings with regional execs can be obtained over a minimal basis in certain locations, although not accessible in all States or destinations. Not all pros deliver in-person services.

smaller business owners can framework their business as a corporation if they want corporate taxation rates. The lawful process recognizes an organization as its personal lawful entity—that means that, lawfully speaking, it’s impartial from your entrepreneurs. So If your business is sued, here the homeowners’ property aren’t on the line.

LLCs may very well be setup as partnerships, companies, or as “an entity disregarded as separate from its operator” (meaning that the operator is taxed as someone, very like a sole proprietor).

In the event your business is assessed to be a Partnership or an S-corp, you must submit your tax return on March fifteen or perhaps the 15th working day in the third month after the conclude of the Firm's tax 12 months.

The strategy introduced Wednesday again opts for an expansive definition — focusing on person charging ports rather then a single credit score for any multi-port installation.

That doesn’t necessarily mean you’ll pay taxes two or 3 times on the identical profits. Most states have a method to reconcile various condition returns, through reciprocity or tax credits, but the exact approach varies.

big businesses often function as C-businesses, so They could confront double taxation at equally the company and shareholder concentrations.

Get matched that has a tax specialist who prepares and files all the things for you. Your committed pro will discover every dollar you have earned, assured.

give facts subject to alter at any time without warning. Intuit, in its sole discretion and Anytime, may possibly figure out that sure tax topics, types and/or conditions are certainly not bundled as A part of copyright Dwell entire provider. Intuit reserves the proper to refuse to prepare a tax return for any cause in its sole discretion. supplemental limits utilize. See phrases of services for specifics.

in its place, report your business income and charges on Schedule C of your individual revenue tax return (type 1040). Any revenue or reduction is then carried about towards your 1040 type as ordinary profits or reduction.

copyright Desktop solutions: cost involves tax preparing and printing of federal tax returns and absolutely free federal e-file of nearly 5 federal tax returns. Additional fees may apply for e-filing condition returns.

If an S Company you individual can’t file its return prior to the 3-thirty day period extension expires, a further a few-thirty day period extension to file taxes (but not to pay any tax owed) is offered by filing sort 7004 and checking the box on Line four.

copyright Desktop goods: Price features tax planning and printing of federal tax returns and free federal e-file of around 5 federal tax returns. supplemental service fees apply for e-submitting state returns.

adjustments for weekends and holiday seasons are currently mirrored when referring to specific 2024 owing dates under.

Angus T. Jones Then & Now!

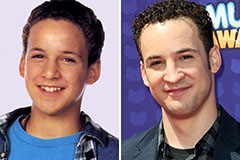

Angus T. Jones Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!